If you’re a freelancer or business owner who uses invoices to bill clients, then you’ll understand how critical invoice numbers are. Can you customize your invoice number using an invoice app?

Yes. Invoice number apps allow you to create invoices and customize it to fit your billing requirements. Invoice numbers play a huge role in keeping records organized and easy to track. Without them, it might be hard to monitor your invoices or, worse, you might send the wrong invoice to your clients.

Customizing An Invoice Number App

An invoice number is a unique identifier of an invoice, specifically for monitoring purposes. When you bill a client, they can easily reference your invoice using the invoice number.

Invoice numbers make invoice management easier. And with it, you can keep track of your invoices and check which ones are paid and pending. It is also easier to remind your clients about their overdue payments.

Another thing that makes invoice numbers important is that they help identify whether payments have been made or not and by who.

For example, Lorielle’s Flower Shop invoices 80 invoices in December. By the end of January, they know that 76 of those invoices have been paid because their clients referenced them the invoice numbers. All they need to do is make a follow-up on the remaining four invoices, which isn’t that difficult, thanks to the invoice numbers.

But do invoices really need to have invoice numbers?

Definitelynine often reject invoices without invoice numbers because it makes payments difficult to track. And when that happens, the vendor might spend more time reissuing the invoices.

What Invoice Number Should You Start With?

Invoice maker apps make invoice numbers customizable. Meaning you can use an invoice number that best fits your business requirements. Moreover, no federal laws or regulations define how you should add invoice numbers when billing clients. Nevertheless, here are some tips on how to add invoice numbers:

By default, invoice maker apps start with invoice 001. If it’s your first invoice for your first client, then this invoice number might work just fine. From there, the next invoice could be 002, 003, 004, and so on.

But let’s use Lorielle’s Flower Shop as an example again. They have 9 clients, and to each client, they send up to 10 invoices in a month. If they use the standard 0001 invoice number, tracking the invoices can be tedious.

To make tracking easier, FLS used a unique identifier for each client. For example, they used GAR to identify their client Gifts and Roses. When invoicing, the invoice number would be GAR001, GAR002, GAR003, and so forth.

The identifier can be numbers, too. For instance, you can use #24 to identify your 24th client. The invoice number could be #24-001, #24-002, #24-003.

Here’s another tip:

Make your invoice number sequential.

Although starting with GAR0029 as your first invoice, in the long run, this can cause confusion on you and your client’s end. It’s always best to start with 0001 and take it from there.

Invoicing is easier when you have an invoice generator app. And if you’re looking for an invoice maker app that lets you create professional and customizable invoices, you’re in the right place.

Introducing Spark Invoice App

Spark Invoice App is the easiest invoice maker in the market.

It allows you to create invoices and send them instantly to your clients. This app helps you to track both your clients and their invoices.

This invoice number app is highly customizable. The invoice numbers are editable, so you can add the unique identifiers just the way you want them. It’s easy and does a great job keeping your records organized and secured.

You can add as many clients as you want and create invoices as much as you need with Spark Invoice App.

How to Add Invoice Number with Spark Invoice App

Spark Invoice App makes adding an invoice number fast and easy. First, download Spark Invoice App. It’s available on both iOS and Android devices.

Spark automatically generates an invoice for you, with fields that you can edit when adding other information. It will also generate an invoice number instantly, which you can use as-is or change. The app will notify you when you attempt to use an invoice number that’s been used already.

This helps you to prevent creating invoices with the same invoice numbers. Take note, it’s important not to use the same invoice number even when you’re invoicing different clients or companies.

Adding an invoice number with Spark Invoice App couldn’t be easier. Here’s how:

After opening the invoice number app, click + New in the Invoices bar.

In the upper left-hand corner is the invoice number, and on the opposite side is the date. By default, the invoice number is 001 with the word Invoice as the prefix. Change the number accordingly.

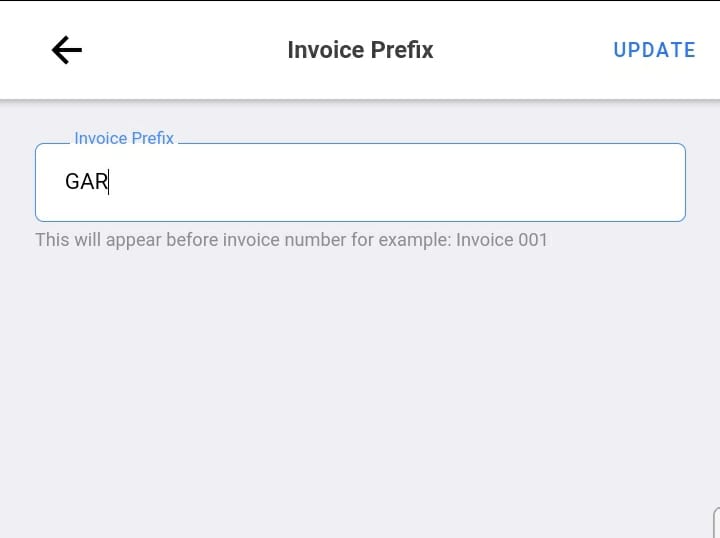

To change the prefix of your invoice number, go to Settings, which is in the bottom right corner of the screen.

Then, hit Invoice Prefix, and edit the field. It’s also in the Settings where you can add or edit your business info, add a business logo, change the tax rate, apply discounts, and modify the currency and date format.

Once you have changed the invoice prefix, you can create a new invoice having the newly assigned prefix.

All you need to do is fill out the rest of the field. Add a client by importing from your contact lists or by putting the client’s information manually. Then, list all the items or services they have acquired from you, including the unit and price.

Add important notes that you want the client to be aware of. You may also add an image, perhaps a proof of the completed work or delivered product.

What’s the difference between invoice and receipt?

Invoices are not receipts. Instead, it serves to notify a client when a payment is due. Receipts are issued when the payment has been made. Sometimes, an invoice is unnecessary, especially when the client pays the products or services in full cash.

Here’s an example:

Sophia’s Bath Bombs supplies bath essentials to some businesses. She issues a client, Kale Bath Outlet, an invoice amounting to $742, which is due in 3 weeks. Kale bath Outlet made the payment five days after the invoice was received through a form of a check. Sophia cashes the check, and Kale can just confirm in the bank if the check has been cashed.

In that case, a receipt was not necessary.

Another example: Sophia doesn’t issue invoices at all. Instead, all the clients come to her store and buy her products in cash. In this case, a receipt is necessary to prove that the products have been paid.

Are you tired of chasing payments from your clients? In another blog post, we explained how to get paid faster and avoid chasing payments from clients.